Technology Solutions

Five of the top 10 banks are already QuantiFacts clients. Find out what gives them a competitive edge.

Fee Modeling and Fee Schedule

Implementation

QuantiFacts has been building fee modeling and implementation applications for years. We have used our own tools in countless implementations, so we know what works, what information is critical for decision making, and most importantly how to set up the model to project what will happen in real world fee implementations.

Changing your fees may impact every client and produce $millions in revenue change for your organization. It’s one of the most important projects you will undertake, and not the time to cut corners with back of the envelope calculations or make mistakes trying to build your own model. Our tools are proven and we have decades of experience to guide you through the important considerations and avoid potential pitfalls.

We think of a fee project in the following steps, and provide technology solutions for each:

- Research: Analyze current state, including current schedules and discounting across the organization and competitive comparisons.

- Set Pricing Objectives: These are objectives you set informed by research from our tools.

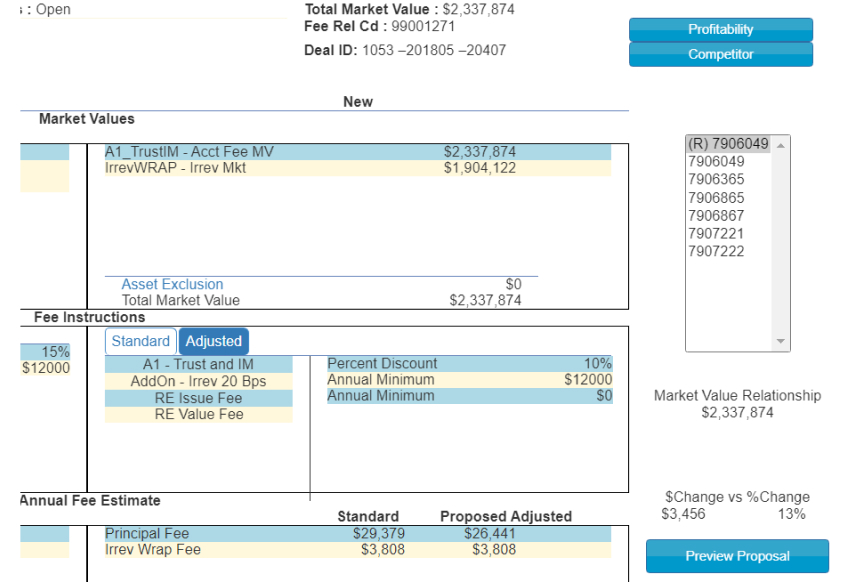

- Fee Modeling to New Schedule Selection: With dashboards customized to your business, quickly see how different fee schedules compare and how well the results fit your objectives. Not in hours, but minutes, interactively with your management team assembled if you wish.

- Fee Implementation: This is where the rubber meets the road and critical to the success of the whole initiative. For more about this see the next section about Deal Manager.

Deal Manager: Fee Negotiation and

Discount Management

Relationship Managers:

What am I charging today? What would I be charging with the right fee schedule and no discounts? How does that compare to my competitors? Is the client profitable to our organization at this price?

Review the deal. Inform the client. Negotiate if necessary, confident you have the best information. Click to change.

Senior Managers:

Is the fee project on track? Are schedules being implemented correctly and fairly? Which officers are doing well and which are missing targets? Are new accounts being set up consistently? Are pricing objectives being met?

Approve or reject discounts and fee schedule changes. See prices across the organization from high-level to client detail.Manage to success.

Q4WMS: Revenue Analysis and

Reporting

See how fee calculations built into a reporting system turn numbers into insights.

The Q4 Wealth Management System (Q4) provides modeling, analytics, and reporting designed specifically for your business. You can report on the business at any level of your organization, from top-of-bank and division officer reports all the way down to the account level. All reports and analytics are backed up by robust data stored at the lowest level of detail, including the specific assets held for each account. This ensures maximum precision for fee modeling, and absolute balances to your bank systems.

Relationship Profitability

Measuring profitability allows you to identify profitable and unprofitable relationships, giving you the insight you need to negotiate aggressively and reduce discounts on unprofitable relationships, and make sure to protect your profitable business. With data that can be aggregated to any level of the organization, you can evaluate your revenue vs. expense levels for each product, region, relationship officer, or client.